Edit: What I really mean by my title is, “the effects of race are real”. Race, of course, is a social construct.

I’ve been sitting on this post for a while, and couldn’t decide whether or not to publish it. I started this blog as a professional tool, a way to jot my thoughts down about macroeconomics and issues like inflation, liquidity traps, Federal Reserve policy, etc. But as long as I have a single reader out there, I feel like I have a responsibility to talk about the issue of economic inequality between blacks and whites – it is real, it is persistent, and it is extremely troublesome.

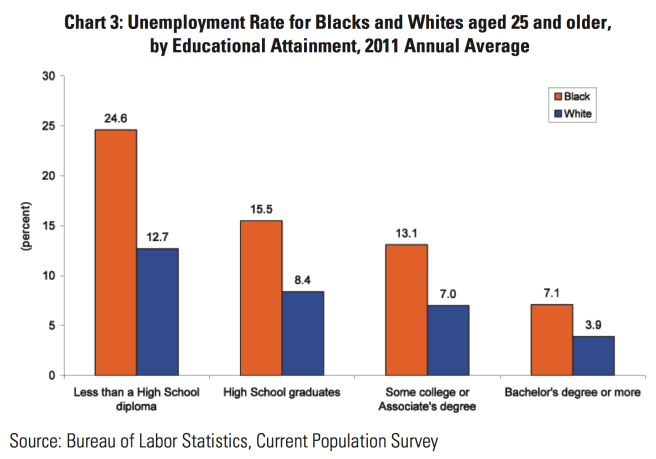

Imagine you were born with black skin sometime before 1986. Big deal, right? In 2011, if you were actively looking for a job, here is the unemployment rate you can expect, compared to your white neighbor, for every level of education:

So, your white neighbor who dropped out of high school would have the same chance of finding a job as you, a student who had earned an associate degree.

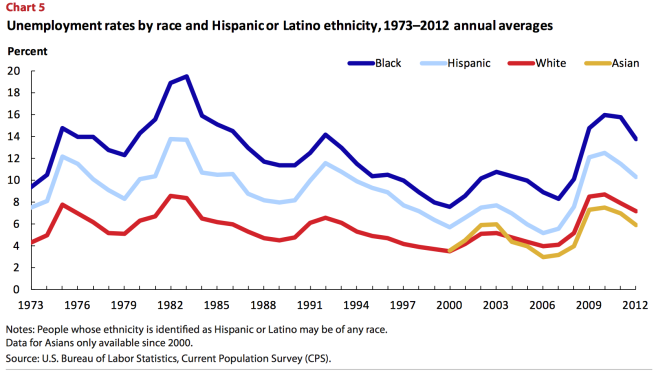

Okay, you might say, but that is in 2011, in the aftermath of a recession. Maybe things are different in “normal” times. Not exactly:

The black unemployment rate is consistently about twice as high as the white unemployment rate. Remember the Great Recession, when white Americans collectively lost their minds, and started both the Tea Party and Occupy Wall Street out of a sense of despair and inequity? Well, the white unemployment rate, topping out at about 8%, was lower than the black unemployment rate at almost every point over the previous 40 years.

Yet we supposedly live in a country where race no longer matters, and blacks are the “real racists” (if you don’t believe that people hold these views, I urge you to read the comment section of any article about Ferguson, or essays on race published in a conservative magazine like the National Review).

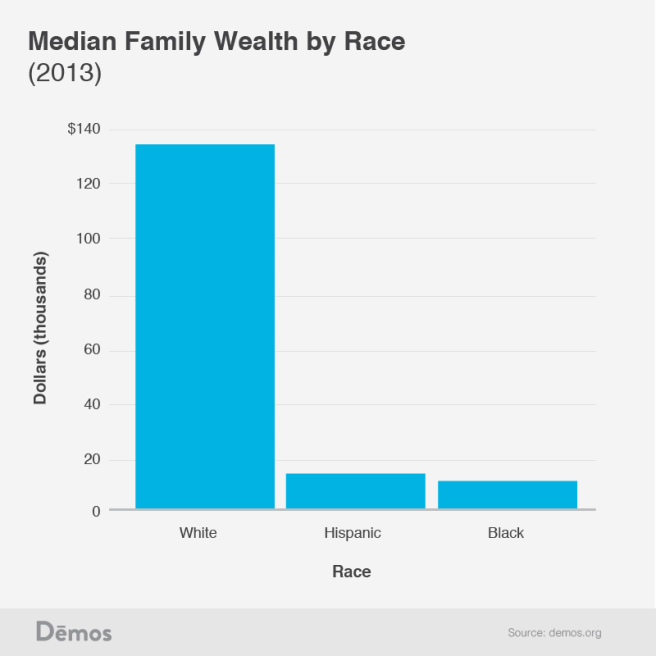

The previous two graphs represent a snapshot in time, and we can easily see that blacks have a much harder time finding employment than whites. But what is the accumulated effect of this over time?

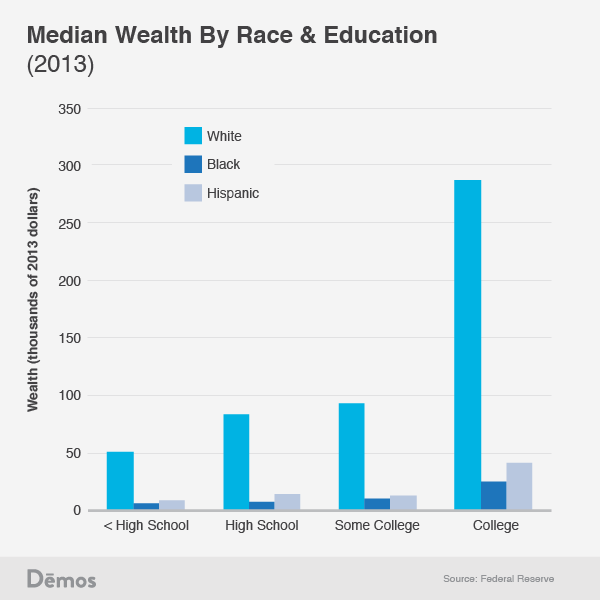

Blacks have virtually no wealth. Most of this is due to the fact that homes in predominately black neighborhoods are not worth as much as those in white neighborhoods, so blacks cannot build equity as easily as whites. This massive wealth disparity remains when controlling for income levels, which I will leave as an exercise to the concerned reader to look up for themselves. Unsurprisingly, it also remains when controlling for education levels:

Again, even when blacks go to college, their household wealth remains lower than white dropouts. Part of this is because going to college does not guarantee blacks a job like it guarantees whites a job. Another large part is because when a large number of blacks move into neighborhoods, home prices plummet, so trying to build equity through home ownership just doesn’t work for blacks like it works for whites.

So, assuming you care, what can you do about this? If you own a business, and have two equally qualified applicants, I would urge you to hire the minority candidate. This might mean choosing that candidate over a family friend, or another individual who has connections to you or to others in your company. So be it. The white applicant will more easily find a job elsewhere.

As for everyone else out there, I’m afraid the answer isn’t so easy. But we at least need to start talking about it. If you are interested in learning more, I would highly suggest reading Being Black, Living in the Red.

——

Sources:

First graph: http://www.dol.gov/_sec/media/reports/blacklaborforce/

Second: http://www.theatlantic.com/business/archive/2013/11/the-workforce-is-even-more-divided-by-race-than-you-think/281175/

Third & Fourth: unfortunately, I lost the link, but there are several similar graphs available at demos.org. A graph adjusted for income can be found here: http://www.demos.org/data-byte/whites-have-more-wealth-blacks-and-hispanics-similar-incomes